Trusted Identity Verification On-site

ID Document Coverage

Thoroughly check ID documents against the world’s most complete ID reference database. We support verification for 6,500+ ID documents.

Facial Recognition

Match a person’s face with the photo on the ID document presented, using biometrics. Our facial comparison technology generates a highly accurate score based on a face match.

Automated Checks

Security features, template database cross-check, MRZ check, VIZ to MRZ comparison, RFID chip validation, RFID picture to VIZ photo comparison, RFID to MRZ comparison and data cross-checks.

Customer due Diligence

Access up-to-date watchlists PEP screening and sanctions intelligence for thorough customer due diligence (CDD), financial crime prevention and risk mitigation.

Image and Data Capture

Bespoke scanning and capturing hardware — such as passport readers, office scanners, high-end web cams and mobile devices — work well with Keesing AuthentiScan.

Fast-track Registration and Onboarding

Optical Character Recognition (OCR) technology converts images of ID document data into machine-encoded text for easy data-entry and enrolment into your business systems.

Accuracy for Efficiency

Our technologies have been developed to be as accurate and user-friendly as possible to boost efficiency and security and speed up business transactions in both online and offline settings.

Compliance and Reporting

Fully compliant with AML legislation and KYC directives. AuthentiScan generates a detailed audit trail for each ID check and offers various options for management reporting.

Secure Data Handling

Storage of ID document data, images and verification reports in a secure database. Data collected by AuthentiScan is securely processed according to GDPR guidelines.

Handling Exceptions

Internal or external helpdesk functionality for handling exceptions. Our Expert Helpdesk is at your disposal for support and conclusive ID checks.

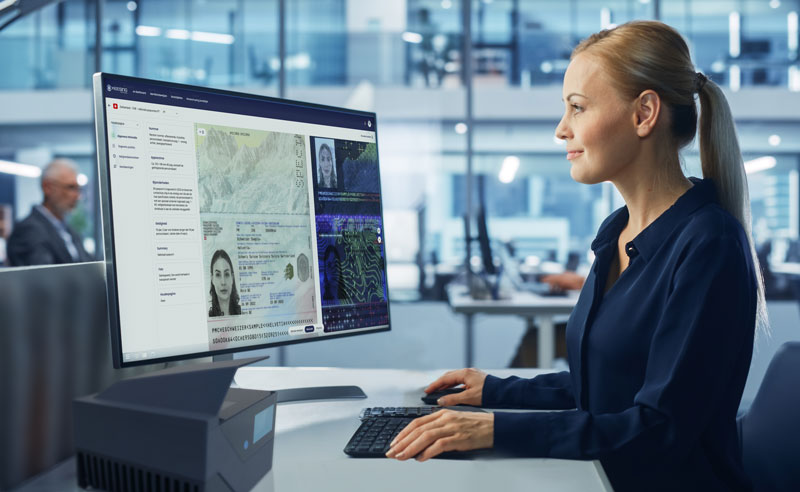

How does it work?

The ID document presented is checked against our comprehensive ID reference data and our high-end technologies enable multiple automated checks of the document to take place to confirm its authenticity. If needed, a picture of a person’s face is taken and matched to the ID photo. AuthentiScan generates a result and if all is well, the ID document data can be used in your business systems, for customer enrolment or visitor badge issuance, for instance.

Get started

We are happy to give you a demo of our identity verification solutions. This live or online experience helps you better understand what our technology can do for your business. And, we are more than happy to answer any of your questions.

Request demo

Fill out the form and we will get in touch shortly.