Levels of Due Diligence: From Simplified to Enhanced

We often hear the terms “due diligence” or “customer due diligence” in business and finance circles. But did you know that there are various levels of due diligence, each geared toward specific requirements and risk levels? Let’s understand these three variances—from simplified due diligence for low-risk situations to enhanced due diligence for high-risk, complex scenarios.

What is Due Diligence

Due diligence is the thorough investigation and analysis conducted before entering into a business transaction. This process helps potential buyers, investors, or partners to make informed decisions by evaluating the assets, liabilities, and overall commercial potential of a business or individual. AML regulations mandate financial institutions and other regulated entities to identify and verify the identity of their customers. CDD is the process that fulfills this requirement.

Read more about AML here.

Banks, insurers, and other financial service providers must prevent their services from being used for criminal purposes. For this reason, they must know their customers well to recognize and assess any risks that may be present.

By preventing and/or detecting misuse of financial institutions’ services by criminals, the integrity and reputation of the institution and the financial system are protected. This is not only important for the financial institution involved but also for the entire economy since a lack of trust in the financial system can lead to economic instability.

Levels of Due Diligence

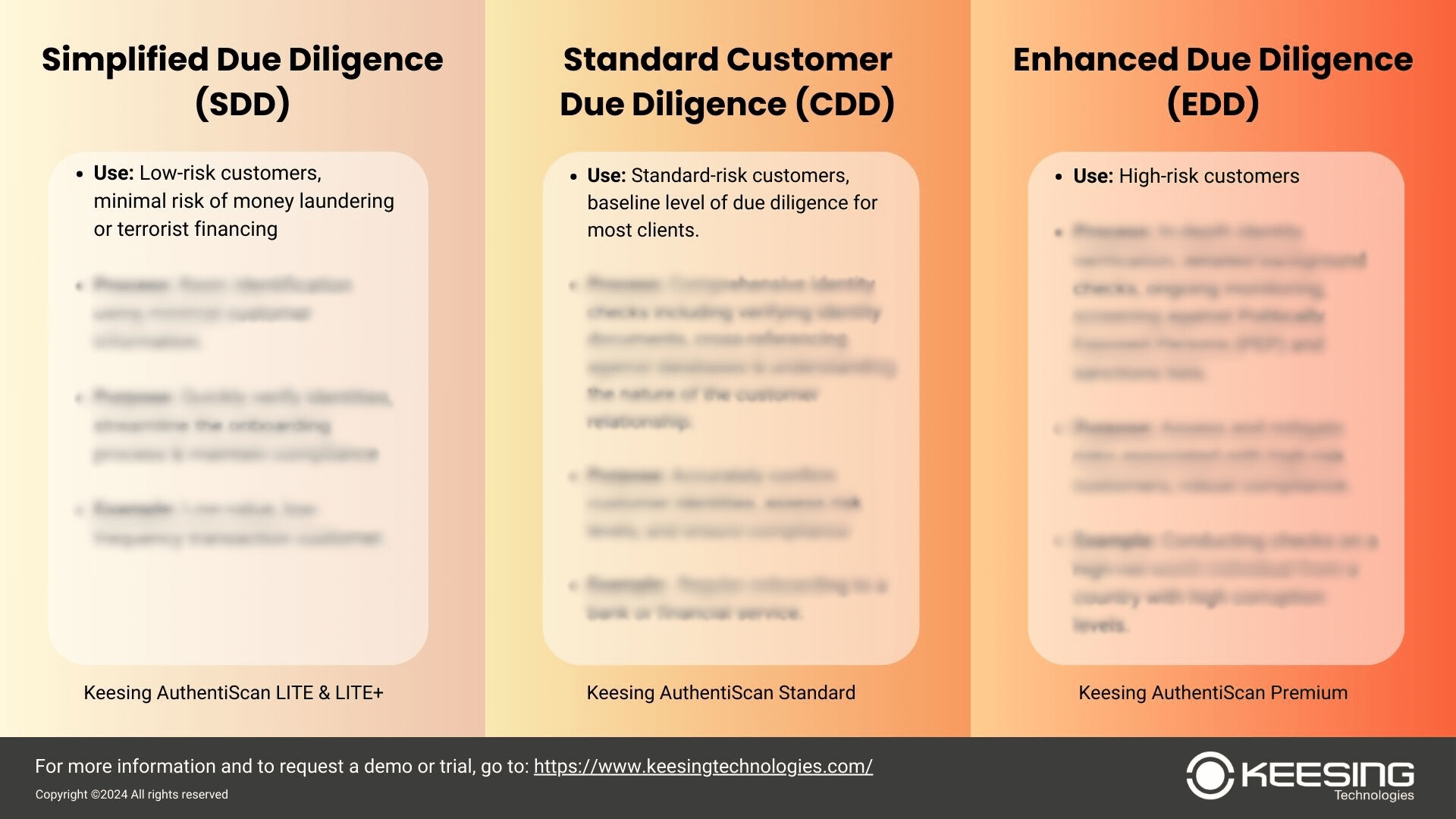

Due diligence processes can be categorized into three levels: Simplified Due Diligence (SDD), Standard Customer Due Diligence (CDD), and Enhanced Due Diligence (EDD). Due diligence is not a one-size-fits-all approach; thus, each level is applied based on the risk profile of the customer and the type of transaction or relationship.

Simplified Due Diligence (SDD)

Simplified Due Diligence (SDD) is the lowest level of due diligence and is applied to customers considered less-risk. These are typically individuals or entities with straightforward financial profiles and transactions that do not raise red flags. In SDD, the amount of information collected, and the extent of verification are less intensive. For instance, basic identification documents are sufficient, and ongoing monitoring is minimal. SDD is commonly used for customers who are public authorities, listed companies, or entities from low-risk jurisdictions.

Standard Customer Due Diligence (CDD)

A standard customer Due Diligence is the standard level of due diligence applied to most customers. It involves collecting sufficient information to identify the customer, understand their financial behavior, and assess the risk they pose. This includes obtaining identification documents, verifying them, understanding the nature and purpose of the business relationship, and conducting ongoing monitoring of transactions. CDD is necessary to ensure that the institution can detect any unusual or suspicious activities that may indicate potential financial crimes.

Enhanced Due Diligence (EDD)

Enhanced Due Diligence (EDD) is required for customers considered high-risk. This could include individuals with high-value transactions, those from high-risk countries, or those involved in complex corporate structures. EDD involves more rigorous checks and a deeper understanding of the customer’s activities. This includes verifying the source of funds, conducting background checks, and closer scrutiny of ongoing transactions. During EDD, individuals are checked against Politically Exposed Person (PEP) and sanctions lists. Being a PEP indicates a higher risk category, such as potential bribery or corruption, but does not imply a crime. Sanctions lists, maintained by governments or international bodies, include those subject to punitive actions. EDD helps in mitigating the higher risks associated with these customers and ensuring compliance with regulatory requirements.

How Keesing Supports Due Diligence

Keesing Technologies offers comprehensive identity verification solutions that support due diligence processes, whether simplified, regular, or enhanced. Our advanced & accurate technology ensures that businesses can meet regulatory requirements and mitigate risks.

For low-risk customers, Keesing Technologies provides efficient and streamlined identity verification services. Our DocumentChecker solution includes quick MRZ checking. For an automated solution, Keesing AuthentiScan LITE and LITE+ perform basic checking in seconds.

For standard-risk customers, you can do a more comprehensive manual check through DocumentChecker, which enables you to closely scrutinize the security features of a document. Keesing AuthentiScan Standard does further checks on UV dullness, ink check, RFID check, and a face comparison which enables customers to send a selfie. The selfie will then be compared to the picture on the document and the chip.

For customers with higher risk profiles, Keesing Technologies offers solutions to perform in-depth checks. With Keesing AuthentiScan Premium, users can do a more comprehensive and detailed verification including cross-checks on the document chip. Additionally, face verification technology and a screening on PEP & Sanctions lists give you additional layers of security.

Consult and experience for free

We understand that choosing the right identity verification solution can be challenging, but we are here to help. Our team is dedicated to guiding you through our range of solutions tailored to different risk profiles. Contact us today to get a free demo or trial. You can also reach out via email or call us at +31(0)207157825.