Exploring the Role of Remote Identity Verification in Banking

Identity verification has an important role in many aspects of banking including opening accounts, know-your-customer (KYC) and anti-money laundering (AML) compliance, high-risk transactions, consumer lending, credit card applications, and many more. As technology continues to advance, banks are at the forefront of adopting innovative solutions for remote identity verification. Non-traditional banks such as digital banks and neobanks have been growing very rapidly and are expected to reach 2.05 trillion U.S. dollars by 2030 in market size- from 47.4 billion U.S. dollars in 2021 (Statista, 2023).

This shift is not exclusive to digital banks; traditional banks are also adopting remote identity verification, moving away from traditional methods like in-person branch visits to embracing technologies for electronic know-your-customer (e-KYC). This change aims to strike a balance between convenience and security. Join us as we explore why identity verification is important and discover how banks are performing identity verification remotely.

What is Remote Identity Verification?

Remote identity verification is the process of confirming an individual’s identity without requiring them to be physically present. In traditional identity verification methods, individuals might need to visit a physical location to prove their identity. However, with remote identity verification, this process occurs through digital channels. The technique of remotely confirming a person’s identity via technology is known as online ID verification.

Why is it Important?

Security

Remote ID verification is essential for online transactions demanding heightened security measures, such as initiating a bank account, utilizing online verification services, submitting a loan application, or accessing sensitive information. The importance of reliable identity verification becomes evident when considering the staggering impact of bank transfer scams, which resulted in the highest fraud loss value in the past year alone with $1.59 billion in the US compared to other payment methods like crypto or gift cards (Statista, 2022). The adoption of automated ID verification adds an extra layer of security by ensuring accuracy, especially when integrated with biometric technology.

Customer Satisfaction & Efficiency

The real-time nature of remote identity verification ensures swift and seamless onboarding processes, contributing significantly to a positive customer experience. According to research, dissatisfaction with customer experience is a leading cause, with banks losing 1 in 5 customers (20%). Shockingly, one in eight banking leaders reported losing 40% of their customer base due to poor customer experiences. By adopting remote ID verification solutions that are not only real-time but also fast and accurate, banks can address these concerns head-on, streamline their operations, and ultimately cultivate higher levels of customer satisfaction.

Customer Retention

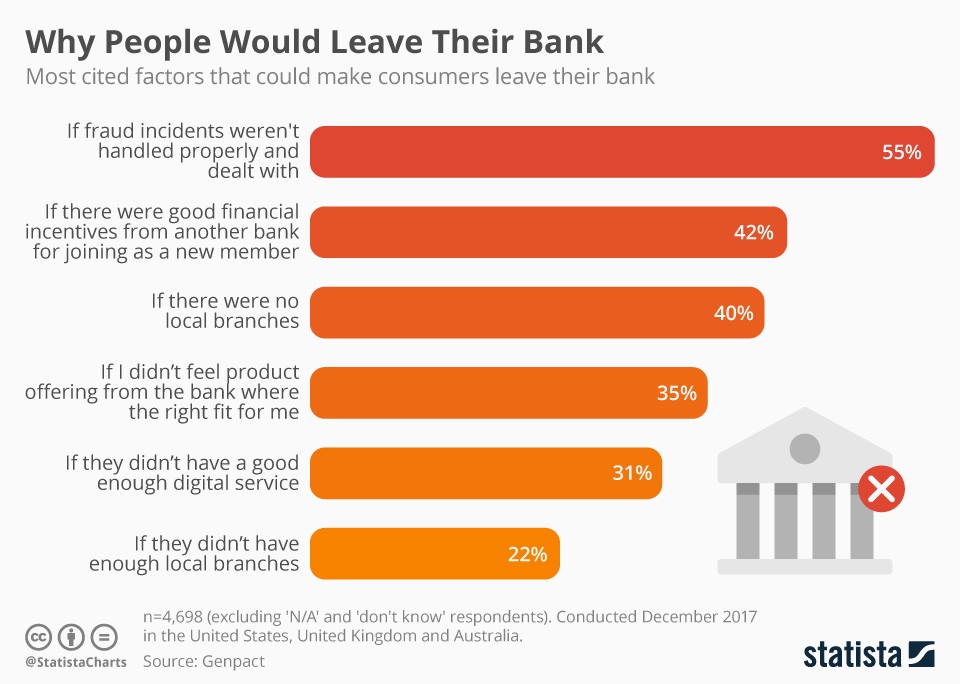

As a bank, prioritizing identity verification is crucial in fostering trust and customer loyalty. The chart below highlights that the most influential factors leading consumers to leave their banks involve mishandling and inadequate resolution of fraud incidents. This proactive approach not only safeguards their financial assets but also instills confidence, making customers more likely to remain loyal to the institution in the long run.

How Do Banks Use Remote Identity Verification?

- First, customers initiate registration through the bank’s online platform. During registration, users typically fill in their contact information such as name, email address, and others. They may also set up login credentials.

- Banks then use various methods for remote identity verification to ensure the accuracy and legitimacy of the information provided by customers, also preventing the use of fraudulent or stolen identities. One common approach is the use of document verification. Customers upload scanned copies or images of official government-issued identification documents, such as driver’s licenses or passports, directly through the online platform. Advanced optical character recognition (OCR) technology is often utilized to extract and verify information from these documents, ensuring that the details match the information submitted during the registration process.

- In addition to document and biometric verification, some also leverage third-party databases and credit bureaus to cross-reference and validate the provided information. This step enhances accuracy by comparing the customer’s details with external databases, checking for inconsistencies or red flags.

- Another widely employed method is biometric verification. Banks may request customers to provide biometric data such as fingerprints or facial scans. Advanced biometric algorithms analyze these unique physical characteristics, which adds an extra layer of security.

- Furthermore, banks may implement multi-factor authentication (MFA) to strengthen the security of the verification process. This involves using two or more authentication methods, such as a combination of passwords, one-time codes sent to registered mobile devices, or even voice recognition.

- Once completed, customers gain access to various banking services, ranging from account management to online transactions. The robust implementation of these verification methods is crucial for regulatory compliance, safeguarding customer accounts, and maintaining the integrity of the financial system.

Keesing AuthentiScan

At Keesing, we believe that a thorough ID document check is essential for establishing a strong foundation in identity verification. With AuthentiScan you have a reliable end-to-end identity verification solution at your disposal: our trusted ID document verification technology combined with cutting-edge biometric identity proofing.

Using Keesing’s biometric identity proofing technology, you can confidently verify an individual’s identity. This provides a means of validating the integrity of the data at the time of collection, allowing for a higher degree of confidence in the validity of the claimed identity and helping your business prevent fraud. Our biometric technology builds on a two-step biometric check including a selfie check (facial recognition).

Facial recognition technology provides the ability to identify individuals by their facial characteristics. Used for identity verification, the technology matches a picture of the individual’s face (selfie) to the ID document photo. First, the users take a selfie. AuthentiScan then compares their facial biometrics to the ID photo and generates a highly accurate face match score, in real-time. If the user’s face is lost at any point in the process, the check fails. This approach ensures that there is no possibility for image spoofing, ensuring a quick, easy, and secure verification process.

Keesing’s selfie check is built to encompass global diversity and has been optimized to perform perfectly with faces of any ethnic origin. It is also fully capable of verifying faces with glasses and headscarves without compromising accuracy.

AuthentiScan has undergone a transformative shift to the cloud, featuring software upgrades for an improved user experience. Transaction times are faster, and enhancements to helpdesk services contribute to a more efficient and reliable system. Moreover, AuthentiScan now boasts increased coverage for Machine Readable Zone (MRZ), enhancing its capabilities in identity verification.

Request a free demo below and discover the advantages of AuthentiScan for seamless ID verification. To learn more or address any inquiries, feel free to reach out to us via email or +31 (0)20 7157 825.